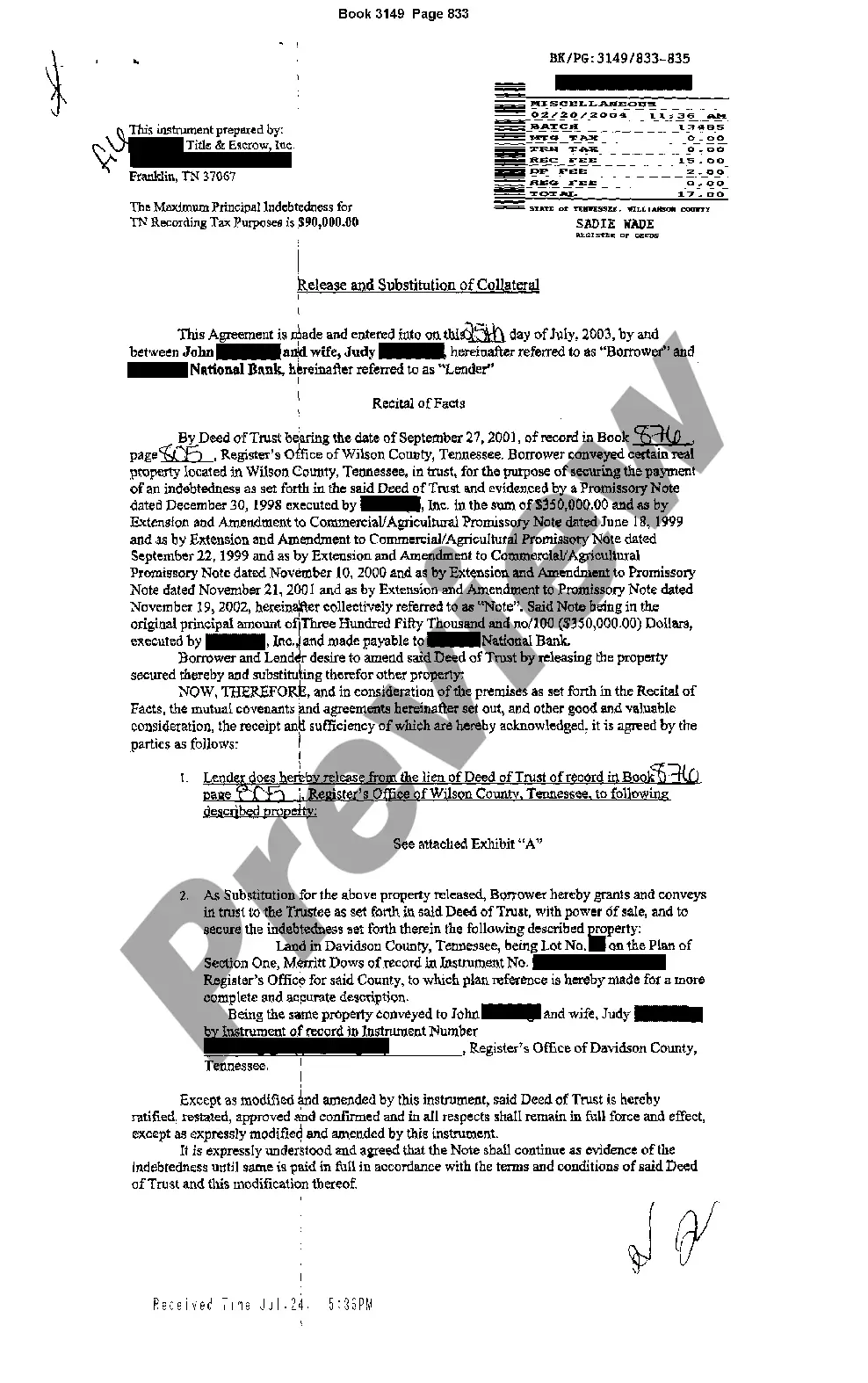

Release and Substitution of Collateral Substitution of collateral auto form for auto loan is an official documentation that allows borrowers to replace the current collateral associated with an auto loan with a new one. This form serves as a means to transfer the security interest from the existing collateral to a different asset, providing the lender with assurance of repayment in case of default. The Substitution of collateral auto form is essential when borrowers wish to replace the existing collateral, typically the vehicle initially used as security for the loan, with a different automobile. By doing so, borrowers can upgrade their vehicle while maintaining the same loan agreement. Keywords: Substitution of collateral, auto form, auto loan, collateral, documentation, borrowers, security interest, repayment, default, existing collateral, different asset, lender, upgrade, loan agreement. Different types of Substitution of collateral auto forms for auto loans may include: 1. Standard Substitution of Collateral Auto Form: This type of form is the most commonly used, enabling borrowers to substitute their current collateral with a new automobile. The form will include necessary details about the existing collateral, the new collateral, and the modification of the loan agreement. 2. Lease Buyout Substitution Form: This form is specific to borrowers who leased a vehicle and now wish to purchase it outright with an auto loan. It allows the substitution of collateral from the leased vehicle to the purchased one while adjusting the terms of the loan accordingly. 3. Trade-In Substitution Form: This form is used when borrowers decide to trade in their current vehicle at a dealership and purchase a new one using an auto loan. It facilitates the substitution of the traded-in vehicle as collateral with the newly purchased automobile. 4. Collateral Value Adjustment Form: Sometimes, borrowers might wish to substitute the collateral due to a decrease or increase in the value of the asset. This form allows the borrower to adjust the loan terms to reflect the updated collateral value accurately. 5. Shared Collateral Substitution Form: In cases where multiple borrowers share ownership of a vehicle serving as collateral, this form is essential for substituting the collateral to remove one borrower's name from the loan agreement or replace it with another person's name. Keywords: Standard Substitution of collateral auto form, Lease Buyout Substitution form, Trade-In Substitution form, Collateral Value Adjustment form, Shared Collateral Substitution form.

Substitution of collateral auto form for auto loan is an official documentation that allows borrowers to replace the current collateral associated with an auto loan with a new one. This form serves as a means to transfer the security interest from the existing collateral to a different asset, providing the lender with assurance of repayment in case of default. The Substitution of collateral auto form is essential when borrowers wish to replace the existing collateral, typically the vehicle initially used as security for the loan, with a different automobile. By doing so, borrowers can upgrade their vehicle while maintaining the same loan agreement. Keywords: Substitution of collateral, auto form, auto loan, collateral, documentation, borrowers, security interest, repayment, default, existing collateral, different asset, lender, upgrade, loan agreement. Different types of Substitution of collateral auto forms for auto loans may include: 1. Standard Substitution of Collateral Auto Form: This type of form is the most commonly used, enabling borrowers to substitute their current collateral with a new automobile. The form will include necessary details about the existing collateral, the new collateral, and the modification of the loan agreement. 2. Lease Buyout Substitution Form: This form is specific to borrowers who leased a vehicle and now wish to purchase it outright with an auto loan. It allows the substitution of collateral from the leased vehicle to the purchased one while adjusting the terms of the loan accordingly. 3. Trade-In Substitution Form: This form is used when borrowers decide to trade in their current vehicle at a dealership and purchase a new one using an auto loan. It facilitates the substitution of the traded-in vehicle as collateral with the newly purchased automobile. 4. Collateral Value Adjustment Form: Sometimes, borrowers might wish to substitute the collateral due to a decrease or increase in the value of the asset. This form allows the borrower to adjust the loan terms to reflect the updated collateral value accurately. 5. Shared Collateral Substitution Form: In cases where multiple borrowers share ownership of a vehicle serving as collateral, this form is essential for substituting the collateral to remove one borrower's name from the loan agreement or replace it with another person's name. Keywords: Standard Substitution of collateral auto form, Lease Buyout Substitution form, Trade-In Substitution form, Collateral Value Adjustment form, Shared Collateral Substitution form.

Free preview Collateral Agreement Real Estate

Finding a go-to place to access the most current and relevant legal templates is half the struggle of dealing with bureaucracy. Choosing the right legal papers needs accuracy and attention to detail, which is why it is important to take samples of Substitution Of Collateral Auto Form For Auto Loan only from reliable sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to be concerned about. You can access and check all the information about the document’s use and relevance for the situation and in your state or region.

Consider the listed steps to finish your Substitution Of Collateral Auto Form For Auto Loan:

Eliminate the headache that accompanies your legal documentation. Discover the extensive US Legal Forms catalog to find legal templates, examine their relevance to your situation, and download them immediately.