A small estate affidavit is a written legal document that authorizes an individual (typically a relative or heir) to claim a decedent’s assets after their loved one has passed. The decedent’s estate can then be administered via the small estate affidavit rather than through a formal and potentially lengthy probate process.

As the name implies, it is typically used with small estates. It’s a sworn statement, which means it must be filled out under penalty of perjury.

Some states only allow you to file a small estate affidavit if there is no will, while others allow you to file one even if there is a will. Make sure to check the state requirements.

Some places require two uninvolved persons to witness your signature, and your state may or may not require you to notarize the affidavit — but that’s not a bad idea regardless. Although the government of your state may not require it, financial institutions that hold the decedent’s assets may need the affidavit to be notarized by a notary public in order to accept your claim.

Again, the process varies. Instead of a notary, Kentucky requires a district court signature, and a few states require a probate judge or clerk to sign off on the affidavit.

The advantage of using a small estate affidavit is that it can save time and expense that can be involved in the traditional probate process.

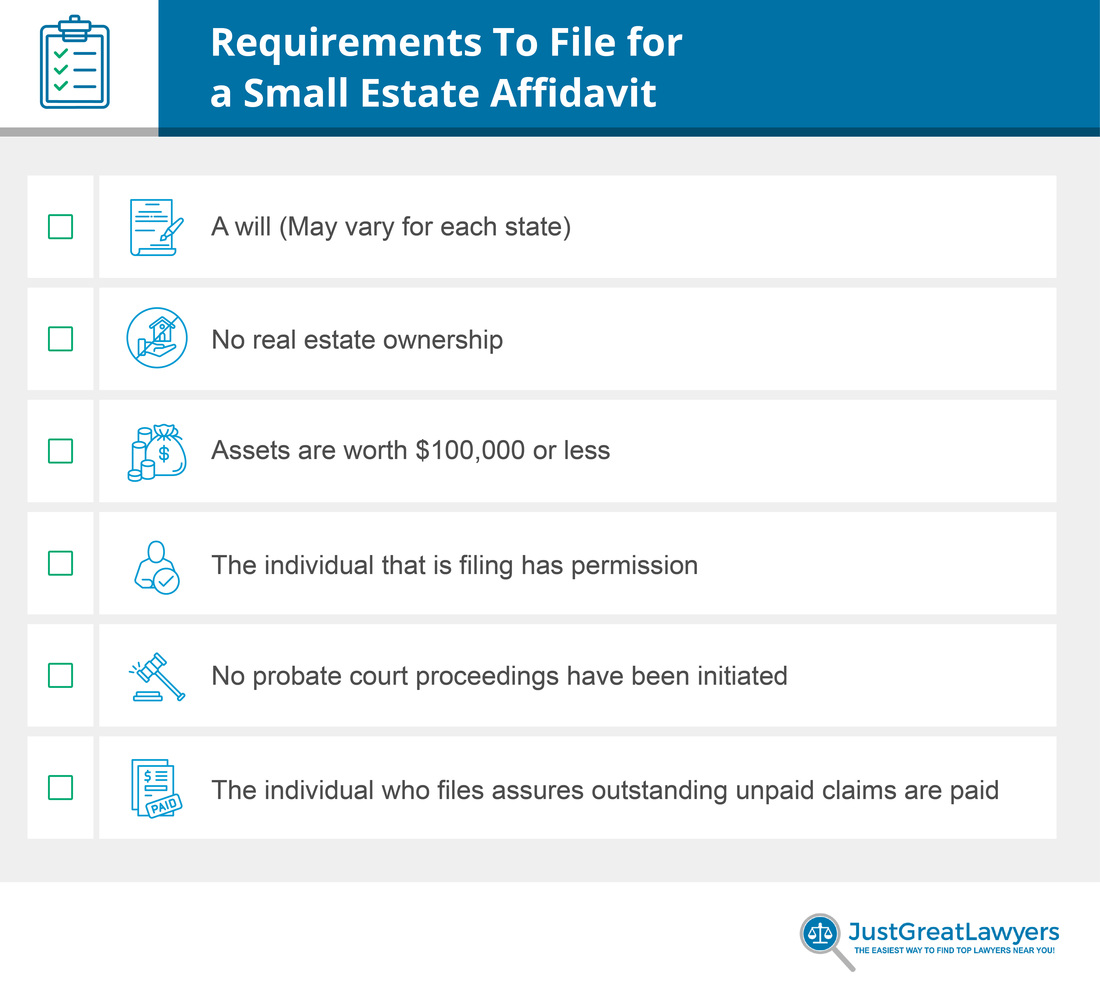

In order to file for a small estate affidavit, you need to meet certain legal requirements, including filing the required documents and, in some cases, waiting a specified period of time after the estate holder’s death.

The estate will also need to meet the definition of a small estate in the state where the affidavit is submitted.

The following are requirements to keep in mind:

In most states, a small estate affidavit cannot be used as a mechanism to transfer real estate. A few states do provide such a process. But real estate transfers are, by their nature, a matter of public record, so the affidavit needs to be filed by a court or with a public agency.

The definition of “small” varies from state to state. In Georgia, for instance, small estates can’t be more than $10,000, but they can be as much as $275,000 in Oregon ($75,000 for personal property and $200,000 for real property). Ohio makes a distinction between a spouse, for whom the level is set at $100,000, and other claimants, who have a much lower limit of $35,000.

The value of the estate can be calculated by adding up the value of all the money and other assets owned by the deceased party, then subtracting debts such as medical bills.

A spouse, domestic partner, children, or parent of the deceased can fill out the form, but it may make more sense to have the executor of the estate fill it out. Whoever does so is called the affiant.

In most cases, heirs can’t use the affidavit procedure if regular probate court proceedings have been initiated or are in progress.

Other than funeral expenses, the individual must make sure all other outstanding claims or any other required expenses (if applicable) are paid in full.

The process of filing a small estate affidavit can be broken down into three steps.

By state law, you are required to wait until a certain amount of time has passed since the decedent’s death before initiating the process of using a small estate affidavit.

This period is most often 30 days, but as with other requirements, this varies from one state to another. Some have no statute regarding a waiting period at all; Colorado and Oklahoma require just 10 days, while Virginia requires 60 and Louisiana 90 days for immovable property.

Once you’ve waited the required amount of time, you can begin the process.

First, calculate the value of the estate and gather all the documents you need. When you’ve got everything in hand, fill out the small estate affidavit. Then you may be required to contact all family members, other heirs, or anyone who has a legal right or claim to a portion of the estate. If this requirement applies to you, you’ll need to do so via certified mail with a return receipt, and keep those receipts so you have a record of having contacted the other individuals. Check with the court to see whether this step is required.

You can find online affidavit forms for small estates that you can download and fill out. They’re available for every state. You can also obtain the form you need by visiting a probate court and filling it out there. Or you can contact your local circuit county court’s clerk and visit their office.

Another option is to schedule an appointment with an attorney and retain their legal services if it’s too overwhelming to handle. Be aware, however, that you may be asked to pay attorney's fees.

Once you’ve completed these steps, it’s time to file your documents with the probate office, together with any filing fee. The clerk will typically take five to 15 days to decide whether to accept or reject your affidavit. If it’s accepted, the assets will be transferred, completing the process.